Building wealth is something most people want, yet very few know where to begin. Some start by saving whatever is left at the end of the month. Others dive into investing with little understanding of risk. Many simply hope things will “work out eventually.” But sustainable wealth doesn’t grow by luck. It grows through intention, planning, and informed decision-making.

This is where a financial adviser becomes far more than a numbers expert. They act as a modern mentor — someone who helps you understand your money, make clearer choices, and build a roadmap that actually leads somewhere meaningful.

In a world filled with financial noise, conflicting advice, and endless options, advisers provide clarity. They help you see the bigger picture, stay focused on your goals, and avoid the mistakes that quietly drain long-term wealth.

This article explores how financial advisers build roadmaps that last, covering their role in planning, risk management, investment strategy, retirement preparation, and long-term financial clarity. Whether you’re an Australian navigating superannuation or someone simply wanting a more secure financial future, expert guidance can make all the difference.

A Modern Money Mentor: Why Financial Advisers Matter More Than Ever

Gone are the days when financial advisers were only for the wealthy or those heavily invested in stocks. Today’s advisers support everyday people who want structure, confidence, and control over their financial lives.

They help you:

- define goals

- simplify complex decisions

- build strategies around your risk tolerance

- understand financial products

- stay accountable

- adapt to life changes

Perhaps most importantly, they bring perspective — something almost impossible to gain when you’re making decisions alone.

A financial adviser is your co-pilot through every financial stage: early career, growing a family, buying a home, investing, protecting assets, and preparing for retirement. Their guidance ensures your financial path is proactive, not reactive.

See more: Retirement Planning for Women: Closing the Wealth Gap

Financial Planning: The Foundation of a Long-Lasting Wealth Roadmap

Smart wealth begins with a plan — not a guess, not a gut feeling, not a quick online calculation. A financial adviser looks at your entire financial picture and builds a personalised roadmap designed to support your goals today and in the decades ahead.

1. Turning Big Goals Into Clear, Measurable Steps

Most people have general goals: buy a home, save more, invest, retire comfortably. Advisers help you turn those vague intentions into detailed strategies.

Instead of “I want to retire early,” your adviser helps you identify:

- how much you’ll need

- how much you should be saving now

- how superannuation fits into the plan

- what investments can support that timeline

Clear steps lead to real progress.

2. Budgeting With Purpose

Budgets aren’t about restriction — they’re about direction. A financial adviser helps create a spending plan that supports your lifestyle while still building long-term wealth.

3. Planning for Life Events

Marriage, children, business growth, buying property, or unexpected challenges all affect your finances. Advisers ensure your roadmap adjusts so you’re never unprepared.

Risk Management: Protecting What You’re Building

Risk is one of the most overlooked areas of personal finance. Many people assume they’ll be fine — until something unexpected happens.

Financial advisers ensure your roadmap includes protection at every stage.

1. Identifying Hidden Vulnerabilities

Many risks stay unnoticed until they become costly problems:

- lack of income protection

- insufficient insurance

- market overexposure

- tax inefficiencies

- inadequate emergency savings

An adviser helps you uncover and resolve these before they impact your financial progress.

2. Making Insurance Work for You

Insurance isn’t exciting, but it’s essential. Advisers help you:

- avoid overpaying

- avoid being underinsured

- understand exactly what you’re covered for

- choose policies aligned with your lifestyle and assets

Good protection keeps your financial roadmap intact when life takes an unexpected turn.

3. Strategic Risk Balancing

From investments to long-term planning, your adviser ensures risk is aligned with your comfort level and goals — not with trends or guesswork.

Investment Strategy: Designing Growth That Fits Your Life

Investing is a powerful tool for wealth creation, but it’s also a source of confusion and anxiety for many Australians. With so many options — shares, ETFs, property, managed funds, superannuation investments — it’s easy to feel overwhelmed.

A financial adviser helps you invest with clarity, purpose, and confidence.

1. Tailored Strategies Based on Your Risk Profile

Everyone has a different comfort level with risk. Advisers balance this with your financial goals to build an investment approach that supports both growth and stability.

2. Removing Emotion From Investing

Fear, excitement, panic, and impatience can lead to poor decisions. Advisers help you stay disciplined, especially when markets move unpredictably.

3. Proper Diversification

Diversification isn’t about owning many investments — it’s about owning the right mix. Advisers structure portfolios that lower risk and maximise long-term returns.

4. Regular Reviews and Adjustments

Markets change. Your life changes. Your goals may change. Advisers keep your investment roadmap updated and relevant.

5. Making Investing Understandable

A good adviser explains every strategy in plain language so you’re never left wondering what your money is doing.

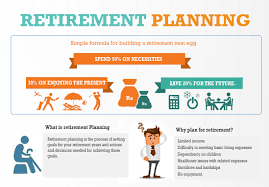

Retirement Guidance: Building a Future You Can Actually Enjoy

Retirement planning is one of the most important parts of a long-term financial roadmap, yet often the most misunderstood. Many Australians assume superannuation will be enough — but without strategy, super rarely reaches its potential.

Financial advisers help you build a retirement plan that takes the guesswork out of your later years.

Here’s how advisers strengthen retirement outcomes:

- calculating how much you’ll realistically need

- maximising super contributions

- optimising tax outcomes

- ensuring your investments support your retirement timeline

- creating reliable income streams for future stability

- preparing for lifestyle changes and longevity

Retirement shouldn’t be stressful. With proper planning, it becomes something to look forward to — not fear.

Long-Term Financial Clarity: The Real Reason Roadmaps Last

While strategies and products matter, the greatest long-term benefit of working with an adviser is clarity.

Clarity gives you confidence.

Confidence keeps you consistent.

Consistency builds wealth.

Financial advisers help you understand:

- where you are

- where you’re going

- what needs to happen next

- how to adjust when things change

This clarity stays with you for life, shaping smarter decisions and reducing financial stress.

Why Australians (and Global Readers) Benefit From Professional Guidance

Whether it’s navigating Australia’s superannuation system, dealing with rising living costs, understanding investment risks, or planning for home ownership, financial advisers simplify the journey.

The benefits include:

✓ Expert insight

Advisers stay up to date with regulations, market changes, and financial strategies.

✓ Accountability

They help ensure you follow through on your goals.

✓ Better outcomes

Professional advice increases the likelihood of stronger growth, better protection, and long-term success.

✓ Peace of mind

Knowing an expert is guiding your decisions removes stress and uncertainty.

✓ Smart tax strategies

Advisers help you avoid unnecessary losses and keep more of your money working for you.

Whether you’re just starting out or already on your wealth-building journey, an adviser helps you build a roadmap that lasts.

Conclusion: Begin Your Smart Wealth Journey Today

Wealth grows when you have clarity, structure, and guidance — and a financial adviser provides all three. They help you turn your financial goals into a practical plan, protect what matters most, guide smart investment decisions, prepare for retirement, and keep you focused through every life transition.

If you’re ready to move from uncertainty to control, consider partnering with a financial adviser who can help you build a long-lasting roadmap to financial confidence and security.

Smart wealth starts with smart guidance — and your journey can begin today.

FAQS

How does a financial adviser create a personalised wealth roadmap? A financial adviser assesses your goals, income, lifestyle, risk tolerance, and future plans to design a personalised strategy. They break big goals into clear steps, structure your savings, optimise insurance, build investment strategies, and adjust the plan over time. This roadmap helps you make confident decisions and stay on track long-term.

Why is risk management important in financial planning? Risk management protects your financial future from unexpected events like illness, job loss, market downturns, or rising expenses. A financial adviser helps identify these risks early and recommends the right insurance, investment mix, and safety buffers. This ensures your wealth plan stays stable through life’s uncertainties.

How can a financial adviser improve my investment results? Advisers use market research, risk analysis, and strategy design to help you invest intelligently. They ensure your portfolio is diversified, aligned with your goals, and adjusted regularly. More importantly, they remove emotion from investing, helping you avoid panic-selling or trend-chasing—mistakes that often reduce long-term returns.

What role does a financial adviser play in retirement planning? A financial adviser calculates how much you need for retirement, strengthens your superannuation strategy, structures tax-efficient saving methods, and builds long-term investment plans. They also help create sustainable income streams for your retirement years, ensuring financial security and confidence as you transition out of work.

When is the right time to speak with a financial adviser? The right time is anytime your finances become more complex—buying a home, starting a family, investing, managing debt, receiving an inheritance, or planning for retirement. Advisers are also valuable if you feel unsure or overwhelmed. Their guidance provides structure, clarity, and confidence to support long-term financial success.